Share

Inflation Adjustment

It is an standard solution that allows you update your inventory adjusting them by inflation rate automatically on three sectors:

Fixed Assets

This solution allows you to adjust fixed assets to inflation rate on a regular way, as part of normal clase activity. It admit revaloraze fixed assets according to inflation by their cost and its historical amortization regarding to the inflation rate.

Revalorization is executed using a program design particularlly for this goal, that work out revalorization values and keep them in an auxiliar Fixed Assets book until the moment in which the amortization is executed. Then the values are counted in a Mayor Book with the amortization.

The system revalorize the amortization values automatically too with adquisition costs and Fixed Assets production, in order to garantee that the Fixed Assets is completelly amortized.

Normally Fixed Assets are revalorized to recurring gaps applying the inflation rate. However, sometimes the government can deliver a new normative that come to an agreement on Fixed Assets of one particular kind which should be adjuted using other rule for a concrete interval. In this case, it can revalorize the Fixed Assets using the manual revalorization operation in a consistent way. When the revalorization program is executed for the interval, it is recognized that the active has been revalorized and you do not try to revalorize again until the new interval.

Mayor Accounts

To adjust inflation rates to Mayor Accounts, it is calculated the adjust by inflation required for each account and it makes the suitable accounting adjusts. The system calculates the inflation in Mayor Accounts.

Normally, individual consignment are just adjust in national current, which are in foreign current are value by an standard program. However it is possible valorize open consignment in foreign currency using this solution, in case of adjust open consigment in foreing currency, the amount of adjust by inflation is divided just like when you steady balance in foreing currency.

When inflation adjust Mayor Acounts there are several cases in which you can probably want to make a compound accountability. En SAP this ones are admit:

*Balance o adjusted positions using an especific inflation rate.

*Balance and positions nominate in foreign currency.

*Interest in interest accounts

Materials

This solution admit the valorization of restocking for materials. Based on business and legal requirements, you can revalorize materials (according to its market price, an inflation rate or both) and after that adjust the stock. Using reposition costs, it can revalorize goods departure por these materials.

Inflation data must be update in the material master data, if you want to include invoices and important payments, you should count them too.

The count solution for inflation for Materials determine a reposition cost for materials, according to the market price or the inflation rate. If it is executed the valoration documents of replenishment in order to update it, the system calculate the effect of especific inflation and count the earning or especific lossing to Mayor Account of material level.

Electronic Credit Invoice

Credit Electronic Invoice is a mothodology that allows PyMEs to fanance easily in countries with high inflation rates.

Finance micro, small and medium companies through early payment of invoices issued to their "big" clients with they have celebrated a sold of goods or services.

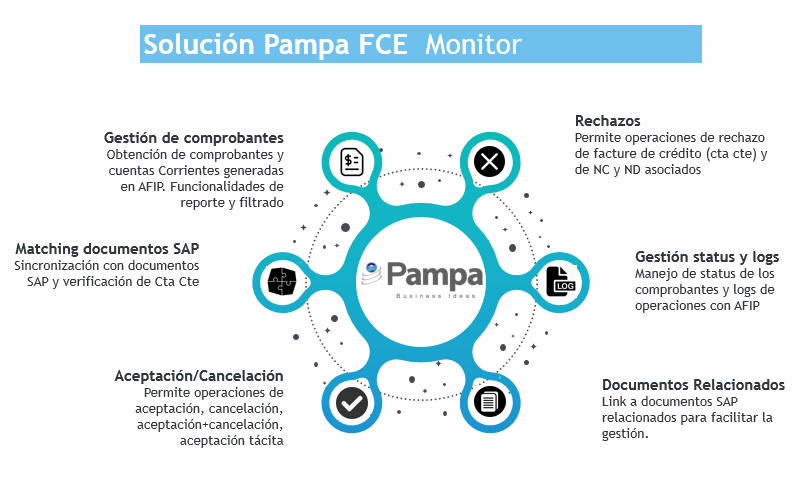

- Management receipts: obtaining receipts and current accounts created in AFIP. Functionalities of report and filtered out.

- Matching documents on SAP: synchronization with SAP documents and proof of current account.

- Acceptance/Payment: it allows operations of acceptance, payment, acceptance + payment, tacit acceptance.

- Rejection: it allows operations of reject credit electronic invoice (Current Account) and credit/debit notes associated.

- Status and logs management: status manage of receipts and logs of operations with AFIP.

- Related Documents: link to SAP documents to make management easier.

Travel Expenses

SAP Travel Management is a submodule of FI, called FI TV that supports all business processes that require the management of a trip within a company. This sub module allows you to request, plan and book trips, create travel expense reports and transfer expense data to other functional areas. Main functionalities:

- Create travel request

1. At the moment that someone from the company needs to travel through the SAP system, create their travel request, where they report details of the trip, transportation and accommodation, cost of the trip, among others. 2. That request is transferred to management, where it is approved or rejected.

- Travel request: approve-reject

1. Once the application is approved, the travel services available in a travel plan and the online reservations in the SAP system are assigned. - Settle travel expenses: 1.When the trip is finished, travel expenses are settled, which includes all the necessary data and documents.

2. Once the settlement is verified and approved by management, the payment is released. 3. Once the trip expenses have been settled, the settlement is approved or rejected for payment.

* For its implementation it is required that the system architecture be enabled to make use of SAP Fiori.

Electronic Invoice with xAFIP

Since AFIP (Administración Federal de Ingresos Públicos/ Federal Administration of Public Income) launched the regulations regarding the Electronic Invoice and the receipt approval online, companies in general (and specifically the SAP companies) have had to deal with this situation adapting to the continuous regime modifications in order to be aligned with the legislation and to have, in time, fast and safe processes in such a critical issue as is Invoicing.

The solution provided by SAP is based on the usage of a PI server to make the connection to the AFIP webservices. The problem is that many companies have not installed the PI server or do not have enough time or budget to implement it. To that effect, Pampa has developed xAFIP, which is a software that manages all the connection between SAP and AFIP. The xAFIP solution is in constant alignment with the modifications of the AFIP regulations, which allows companies to reduce time and risks when implementing these modifications.

Credit Management in SAP

The credit collections area in a company is the key factor within the organization. Before a sale takes place, the Credits are has to decide to who, what amount and what time they will sell at and after the sale, the collecting area checks that the pay times are met; otherwise the area takes measures in order the ensure the collection as soon as possible. This is directly related to the company´s income and to the workforce, both reflecting upon its financial health.

The Credit Management solution developed by Pampa is based in the SAP standard functionality and allows verifying the available credit the clients has when the SAP sales documents are created or modified.